Introduction to QLCredit

In today’s fast-paced digital world, access to credit has become a crucial aspect of financial freedom. Yet, for many individuals and small businesses, navigating the traditional credit system can feel like an uphill battle. Enter QLCredit—a platform that’s not just another player in the game but rather a game changer. With its innovative approach to lending and user-friendly technology, QLCredit is breaking down barriers and making credit accessible to everyone. Whether you’re looking to finance a dream project or cover unexpected expenses, this platform promises a fresh perspective on obtaining funds in our increasingly digital age. Let’s explore how QLCredit is reshaping the landscape of credit access for all.

The Traditional Credit System and its Flaws

The traditional credit system has long been a cornerstone of financial transactions. However, it comes with significant flaws that impact millions.

Credit scores play a pivotal role in determining access to loans and mortgages. Yet, these scores can often misrepresent an individual’s true financial behavior. A missed payment or high debt ratio can drastically lower one’s score, limiting opportunities for many.

Additionally, the lengthy approval process creates barriers. Applicants face tedious paperwork and extended waiting periods that discourage them from seeking necessary funds.

Moreover, traditional lenders frequently overlook those with limited credit histories or non-traditional income sources. This leaves countless individuals excluded simply because they do not fit conventional molds.

Discrimination is another issue within this framework; marginalized groups often encounter systemic biases in lending practices. These factors collectively illustrate why the need for reform is urgent in today’s fast-paced economy.

How QLCredit Works

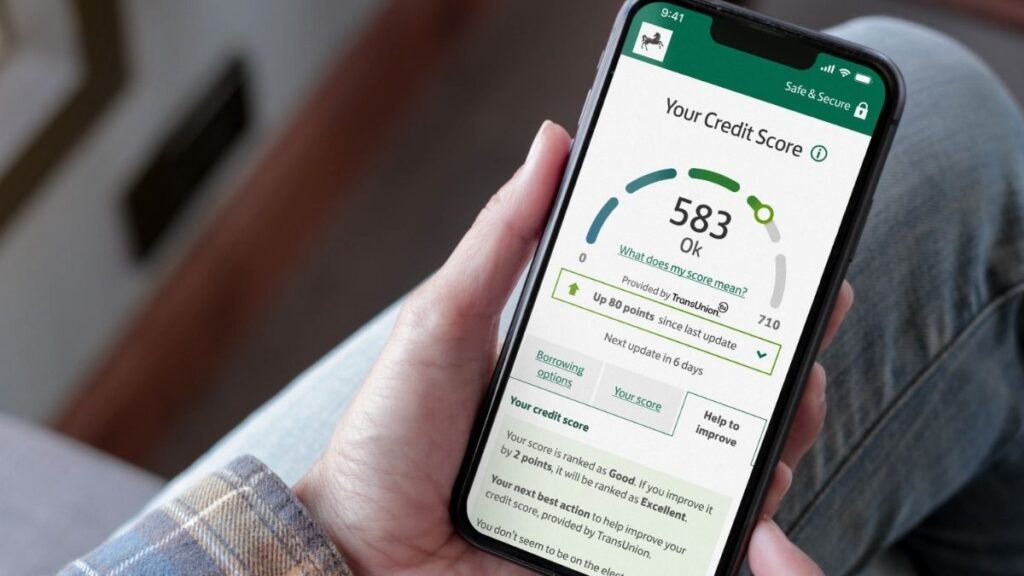

QLCredit simplifies the lending process by leveraging technology. Users start by creating a profile on the platform, providing essential details about their financial history and current situation.

Once registered, an algorithm assesses creditworthiness more accurately than traditional methods. This approach considers factors beyond just credit scores, such as income stability and spending habits.

After evaluation, users receive personalized loan offers tailored to their needs. The entire process is transparent; borrowers can easily review terms and conditions before accepting any offer.

Funds are disbursed quickly, often within hours. This efficiency allows individuals to address urgent financial needs without lengthy delays associated with conventional banks.

With QLCredit, there’s no need for extensive paperwork or in-person visits. Everything is managed online, making access to credit seamless and convenient for today’s digital-savvy consumers.

Benefits of Using QLCredit

QLCredit offers a fresh approach to accessing funds quickly and efficiently. One of its standout benefits is the simplified application process. Users can complete their applications online in just a few minutes, eliminating long waits often associated with traditional lenders.

Flexibility is another key advantage. QLCredit provides various loan options tailored to different financial needs, whether it’s for unexpected expenses or planned purchases. This adaptability helps users feel more secure in managing their finances.

Moreover, QLCredit leverages technology to assess creditworthiness differently. Instead of relying solely on conventional credit scores, it incorporates alternative data sources, making approval possible for individuals who might otherwise struggle to obtain credit.

Transparency plays a vital role in user satisfaction. Clear terms and no hidden fees mean borrowers know exactly what they’re getting into, fostering trust between the platform and its users.

Success Stories from QLCredit Users

Many users have shared their transformative experiences with QLCredit. For instance, Sarah, a freelance graphic designer, utilized the platform to secure funds for her business expansion. The quick approval process allowed her to invest in new software and marketing strategies.

Another user, Mike, faced unexpected medical expenses. Traditional institutions would have taken days or even weeks. With QLCredit, he received the necessary funds within hours. This timely support helped him avoid financial strain during a challenging time.

Then there’s Jessica, who needed capital for her startup idea. Through QLCredit’s transparent terms and accessible guidelines, she found herself empowered to launch her venture without unnecessary hurdles.

These stories reflect how QLCredit is reshaping lives by making access to credit more efficient and user-friendly. Each success story adds another layer of trust in this innovative approach to personal finance management.

The Future of Credit with QLCredit

As technology advances, the future of credit is shifting towards greater inclusivity. QLCredit stands at the forefront of this transformation. By leveraging innovative solutions, it offers a transparent and user-friendly experience.

With real-time data analysis, QLCredit can assess creditworthiness in ways traditional systems cannot. This opens doors for many who have been overlooked by conventional lenders.

Artificial intelligence plays a crucial role too. It tailors lending options to individual needs, creating personalized financial pathways. The algorithm adapts with every interaction, learning from users’ behaviors and preferences.

Moreover, security remains paramount in this digital age. QLCredit prioritizes safeguarding personal information through advanced encryption methods.

The potential to democratize access to credit has never been more attainable. As society becomes increasingly digitized, platforms like QLCredit are not just evolving—they’re redefining what it means to borrow responsibly in the modern world.

Conclusion

The landscape of credit is changing, and QLCredit stands at the forefront of this transformation. Traditional systems often leave many individuals underserved or struggling to navigate complex requirements. QLCredit addresses these issues head-on by offering a more accessible solution that prioritizes user experience and financial inclusion.

As we move deeper into the digital age, it’s clear that innovations like QLCredit will play a crucial role in shaping how people access credit. With its streamlined processes and emphasis on transparency, it empowers users to take control of their financial futures.

Success stories from real users are proof that QLCredit is making a difference. From funding unexpected expenses to helping individuals build better credit histories, the platform has shown its potential in changing lives for the better.

With each step forward, QLCredit not only redefines what it means to borrow money but also sets new standards for accountability and service in the lending space. As technology continues to advance, so too will opportunities for consumers seeking fairer access to credit solutions.

Embracing platforms like QLCredit could be key for anyone looking to navigate today’s financial challenges effectively. The future looks bright as we continue witnessing this evolution unfold.